Revolutionizing Automotive Lending

Simplifying Auto Finance for Success

Ensuring all customers, including those with challenged credit, are matched with the right lender in seconds.

Streamlining the Application process for F&I Managers of all experience levels.

Customized to fit your business

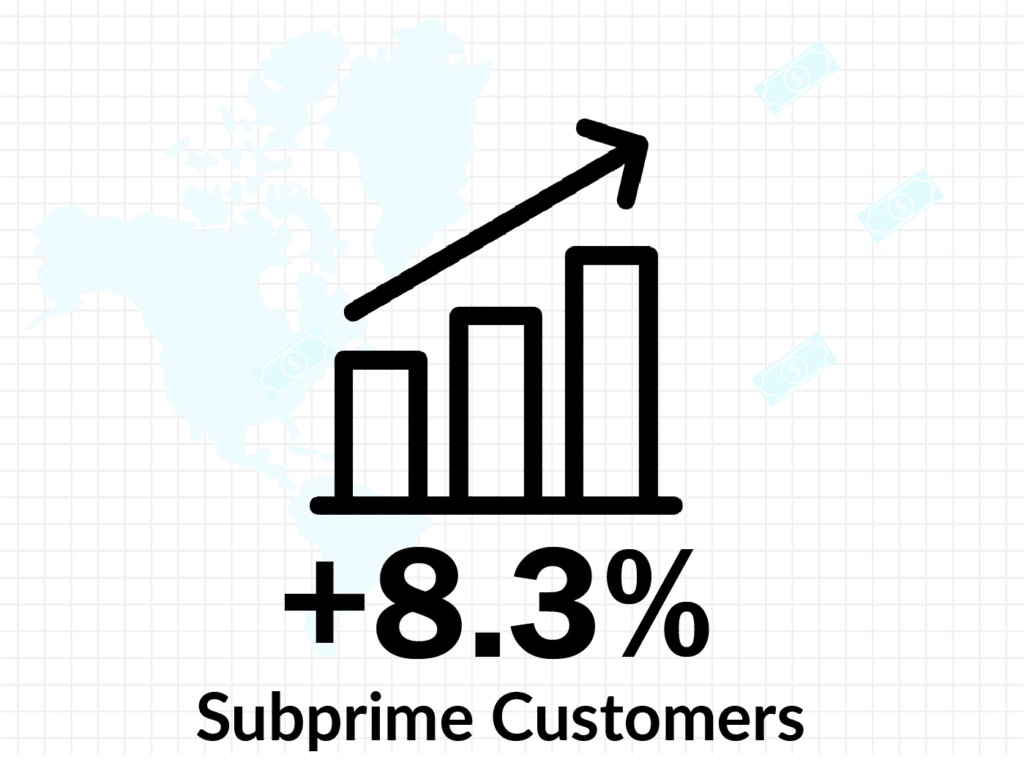

50% Increase in Non-Prime Sales

The impact of recent economic downturns has led to an

increase in the subprime segment.

Dealers can benefit greatly by considering several vehicle loan choices from a range of lenders. This approach allows them to offer their customers an auto loan deal that boasts favorable interest rates and terms that are truly competitive.

SAM Widget

An online form for your dealer website, that uses a unique predictive AI loan-matching system, customers get approved 85% of the time, whether they have prime, near-prime, subprime or even deep subprime financial profiles.

Lucy Platform

Manages every aspect of the financing process. From customers acquisition and credit pre-qualification to the nurturing of clients. Equip your F&Is with Lucy and get 85% of your clients approved for credit.

API Solutions

Technology partners access the Lucy software, resources and APIs to build complementary solutions to address their customer needs. Get more consumers financed, regardless of their financial condition.

Created by Dealers, for Dealers

Dealership Benefits

Maximized Revenue

Experience a higher rate of approvals as our AI technology identifies optimal lender matches for every customer.

Expanded Customer Base

Attract a broader spectrum of customers, including those with non-prime credit profiles.

Informed Decision-Making

Equip F&I professionals with data-driven insights that guide them toward well-informed lending decisions.

Customer Benefits

Faster approvals

Get real time pre-qualification results with all lenders, maximizing speed to approvals.

Inclusive Opportunities

More customers, including those with challenging credit profiles, gain access to vehicle financing solutions.

Improved Customers Satisfaction

Makes the process of buying a vehicle more enjoyable.

Customer Success Stories

"With SAM, pre-qualified lead conversion to sales has skyrocketed, boosting revenue effortlessly."

We approved 21 clients of which we made 10 sales. These are 10 sales that we couldn't have done without Decisioning IT. Our ROI is very high since the profitability generated by these non-prime sales largely exceeds the platform cost.

"Utilizing the Widget, salespeople now initiate the sales process with the right vehicle for non-prime consumers."

"Thanks to SAM, profitability at the F&I office has surged, driving remarkable financial gains."

Decisioning IT products are very practical. Notes on files, lender conditions, customer credit analysis (useful to break client expectations before being more gentle).

I love the fact that has paperless documents, automatic reminders, text messaging. It has boosted my productivity by at least 20% and that’s without counting on the automated credit decisions!

"With SAM, pre-qualified lead conversion to sales has skyrocketed, boosting revenue effortlessly."

We approved 21 clients of which we made 10 sales. These are 10 sales that we couldn't have done without Decisioning IT. Our ROI is very high since the profitability generated by these non-prime sales largely exceeds the platform cost.

"Utilizing the Widget, salespeople now initiate the sales process with the right vehicle for non-prime consumers."

"Thanks to SAM, profitability at the F&I office has surged, driving remarkable financial gains."

Decisioning IT products are very practical. Notes on files, lender conditions, customer credit analysis (useful to break client expectations before being more gentle).

I love the fact that has paperless documents, automatic reminders, text messaging. It has boosted my productivity by at least 20% and that’s without counting on the automated credit decisions!